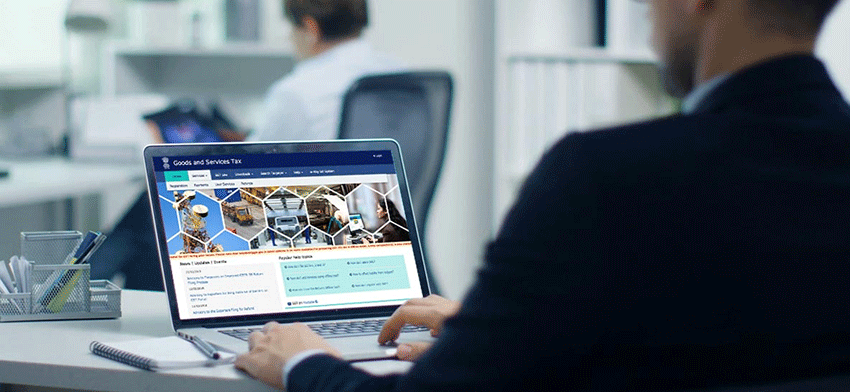

The Goods and Services Tax (GST) is a comprehensive indirect tax system introduced in India on July 1, 2017. It subsumes various central and state taxes like VAT, service tax, excise duty, and more into a single unified tax. GST aims to create a seamless national market by removing tax barriers between states and ensuring the smooth flow of goods and services. GST registration is a crucial step for businesses operating in India, enabling them to collect and remit GST.

GST registration is a critical requirement for businesses in India, providing numerous benefits such as legal recognition, input tax credit, and simplified compliance. By registering for GST, businesses can streamline their operations, reduce tax liabilities, and gain a competitive edge in the market. The registration process is straightforward, and the online portal makes it accessible to all businesses, ensuring that they comply with the tax regulations set forth by the government.